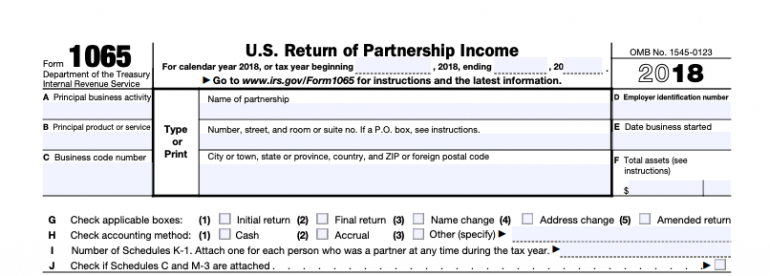

The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher. government material.)Īll rights reserved. It is possible that future guidance will address this issue.įor questions about this relief or other tax issues, contact a member of the Ballard Spahr Tax Group. However, it is not clear if or how a this election can be revoked. The fix to the retail glitch may provide many partnerships with reasons to rethink that election. Importantly, as noted above, many partnerships that are real estate trades or businesses made irrevocable elections permitted under IRC Section 163(j) to deduct all interest expenses in lieu of claiming immediate expensing of eligible real estate assets because such an election made little difference if the partnership could not expense QIP. Amended returns under this procedure must be filed by September 30, 2020.įor partnerships not subject to the BBA partnership audit rules, the normal rules allowing the filing of amended returns continue to apply.Īlthough this guidance is helpful, it does not address all questions applicable to partnerships. Only partnerships that (i) are subject to the BBA centralized partnership audit regime, (ii) filed Form 10 or 2019, and (iii) provided Schedules K-1 to their partners are eligible for the relief. 2020-23 specifically refers to the relief provided by the CARES Act, a partnership can file an amended return for any issue related to tax years beginning in 2018 or 2019. 2020-23 provides that, notwithstanding the prohibition against amended returns for partnerships subject to the BBA partnership audit rules, such partnerships can file amended IRS Forms 1065 for tax years beginning in 20 or file an AAR. Also, if the ownership of the partnership has changed since the tax year that is being adjusted, an AAR would provide benefits only to persons who are partners of the partnership in the year of the AAR (not the prior year partners). Such a partnership instead is required to file an administrative adjustment report (AAR), which would delay the benefits to the partners until 2021. However, partnerships that are subject to the BBA’s centralized partnership audit rules are not able to simply file amended returns for tax years beginning in 2018 or 2019. The retail glitch fix was widely welcomed. Taxpayers now may immediately expense QIP acquired and placed into service after September 27, 2017, subject to the phase-out beginning in 2023.

The CARES Act fixed the retail glitch by assigning a 15-year MACRS life to QIP and a 20-year ADS life to QIP, effective as if these changes were enacted as part of the TCJA.

A taxpayer who made the election to deduct all of its interest expense was required to use ADS lives for such real estate assets.

Also under the TJCA, a real estate trade or business had an election either to take bonus depreciation on eligible real estate assets or deduct all of its interest expense (avoiding the 163(j) interest deduction limitations). Although Congress intended for QIP to be eligible for 100 percent expensing, a glitch in the TJCA omitted QIP from property eligible for expensing (the “retail glitch”). The Tax Cuts and Jobs Act (TCJA) allows bonus depreciation-100 percent expensing-for qualified property subject to a phase-out beginning in 2023 (dropping 20 percent each year until completely phased-out at the end of 2026). 2020-23 (available here) allowing partnerships subject to the BBA partnership audit rules to file amended returns to take advantage of retroactive tax benefits in the CARES Act, including the qualified improvement property (QIP) fix (described in our alert here).

0 kommentar(er)

0 kommentar(er)